An Analysis of Dogecoin

Posted: February 6, 2014 Filed under: Cryptocurrency | Tags: analysis, bitcoin, crypto, cryptocurrency, dogecoin, economics, moon 94 CommentsDisclaimer: This article is now outdated. It was written in early 2014. I am no longer involved in crypto, , and hold no opinion on current trends.

You may read the outdated article below:

Introduction:

For those of you who don’t know me, I am Tuxedage — organizer of the dogecoin lite wallet fund, moderator of the thousand-user strong #dogecoin and #dogecoin-market IRC channel, as well as an active member and supporter of the dogecoin community. If you are reading this, I will assume you are already familiar with cryptocurrencies, so I won’t beat around the bush.

This document explains why Dogecoin is going to the Moon.

Personal Story:

I am a Bitcoin early adopter. I put in trivial amounts of money into Bitcoin because I saw it as a protocol and community with significant potential. I have made some ridiculously good returns on my initial investment because of that decision.

When I first heard about Dogecoin in mid-December of 2013, I initially dismissed it as a stupid meme coin. I publicly stated that I do not understand Dogecoin, and that anyone who put money into it was stupid. In my mind, Dogecoin was simply a useless clone that tried to imitate Bitcoin’s success, one that was doomed to inevitable failure.

But then I started to think about it more seriously. Were my initial criticisms of dogecoin valid? Could I have been wrong?

I was wrong.

On Christmas of 2013, I became a dogecoin believer. A shibe.

Over the next week, I cashed out every single one of my bitcoins that I had bought into dogecoins. At the start of the New Year, I was officially all-in on dogecoin.

At that time, doing so was completely and utterly insane. Dogecoin’s market cap was barely 7 million. Dogecoin was still a speculative and new meme currency — unworthy of attention. All the cool projects we’ve funded, such as the various Olympic candidates, had not yet existed. Furthermore, I had willingly violated the two rules essential of investing:

- (1) Don’t put in money you cannot afford to lose

- (2) Don’t put all your eggs in one basket.

This essay was written to explain my reasoning about why I did this, and why I continue to all-in on dogecoin. I like to justify my actions. Writing this document serves as a quick and easy way to refer people to if they ask me “Why did you do it?”

The second reason why I wrote this essay was because I saw no satisfactory document that met my standards of eloquence in explaining how ridiculously undervalued dogecoin is. Whilst many of the following factoids are scattered throughout the internets or on reddit, they are hidden behind some level of obscurity, and there is no single document listing all of them. Therefore I must do it.

Thirdly, I wanted to archive my thoughts so that in the future, I will be able to remember my exact reasoning for doing this. Memory is often faulty, and I didn’t want to misremember myself as being more overconfident or under-confident than I actually was.

I realize that writing this document in and of itself breaks the spirit of dogecoin. Firstly, because it talks about profit-making, rather than community-building. As we like to say; Community before profits. The dogecoin community is not typically very fond of profiteers who care about the coin only for a quick buck, rather than because they genuinely believe in dogecoin and support it as a mechanism for change.

Writing this document casts me in a bad light as a greedy profit-maximizer. It also may lead to greater amounts of speculation and a greed-fueled hype bubble in dogecoin, which may destroy the very thing we are attempting to accomplish. Furthermore, this document takes a serious tone, and I dislike that. I enjoy dogecoin because it allows me to act like an idiot and talk in shibespeak.

Because of the aforementioned reasons, I have hesitated to write this for a very long time. But eventually, I broke. In an ocean of people talking about how dogecoin would never work, I just wanted to grab the nearest person, and yell at them “BUY DOGECOIN!” whilst shaking them vigorously and slapping them across the face. Of course, I can’t do that over the internet, so writing this document was the next best thing.

So I relented. Much sorry. Very apology. Wow.

The Prediction

This is my conservative estimate. My optimistic estimate is that dogecoin is going to hit escape velocity and pierce the heavens! Not just the Moon, but Alpha Centauri as well. Even reaching ten cents per coin is not impossible! Why maybe even a dollar per coin!

The Argument:

Why am I so confident of this?

The biggest and foremost reason is that dogecoin has an insanely high reproduction number (R-factor). I first identified this phenomenon during 20 Jan, and so far, the evidence heavily confirms it.

A basic reproduction number is a variable used in the modelling of infections to determine, on average, the number of people the carrier spreads the disease to over the course of a certain period of time. The higher this variable, the faster this disease spreads, and the more dangerous and infectious it is.

Dogecoin has a number of traits about it that causes it to spread incredibly quickly – traits that cannot simply be explained by the fact that it is a new coin. Each dogecoin convert tends to spread dogecoin to a high number of other people within a short number of time.

I believe this is because dogecoin exists not only as a p2p protocol, but as a powerful cultural meme. I use meme not merely in the context of being an ‘internet meme’, where funny pictures of various animals are captioned with funny text, but of the classic Richard Dawkins definition – a powerful, self-replicating idea that spreads from person to person.

This meme has is so ridiculously good at self replication for the following reasons:

____________________

Just the Tip

Although my involvement with bitcoin has waxed and waned over the last few years, I was still lucky enough to observe its growth from very early days, despite being unable to make a decent profit from it. One big difference between dogecoin and bitcoin during its early days is the inclination of its users to tip each other small amounts very frequently. This is not just anecdotal – a quick search on the statistics of the dogetipbot vs. the bitcointip bot on reddit will confirm that dogecoin is tipped around 100x as much as bitcoin.

This strikes me as an incredibly effective evangelizing tactic.

This works for three reasons, the first being the most obvious – if you have been tipped some dogecoins, you’re very likely to download a wallet and try to keep some marginal involvement with the dogecoin community. After all, who’s going to refuse free money? Even if the opportunity cost of downloading that wallet and researching the protocol may outweigh the amount of money that value of dogecoin is worth, I suspect that not many people will do so. My own experiences proselyting dogecoin only confirms this.

This is because when people try to evaluate the current value of dogecoins that they are receiving, their minds will anchor to the next-closest situation that they are familiar with of people being given free cryptocurrency.

That is bitcoin. Stories about people having hundreds of bitcoins in the past, but throwing them away, are all too frequently heard. People will fear throwing away their dogecoins in the subconscious fear that the same situation will result. They will believe that it is “better to be safe than sorry”, regardless of how utility maximizing doing so actually is.

The second reason is the reciprocity principle. As someone generally very interested in social engineering, the desire for people to reciprocate is usually so powerful that it is so often taken advantage of by confidence-tricks. The following experiment is told as an example:

- Regan had subjects believe they were in an “art appreciation” experiment with a partner, who was really Regan’s assistant. In the experiment the assistant would disappear for a two-minute break and bring back a soft drink for the subject. After the art experiment was through, the assistant asked the subject to buy raffle tickets from him. In the control group the assistant behaved in exactly the same manner, but did not buy the subject a drink. The subjects who had received the favor, a soft drink, bought more raffle tickets than those in the control group despite the fact that they hadn’t asked for the drink to begin with. Regan also had the subjects fill out surveys after they finished the experiment and found that whether they personally liked the assistant or not had no effect on how many tickets they bought. One problem of reciprocity, however, focuses on the unequal profit obtained from the concept of reciprocal concessions. The emotional burden to repay bothers some more than others, causing some to overcompensate with more than what was given originally. In the Regan study, subjects paid more money for the tickets than the cost of the (un-requested) soft drink.

The fact that these tips are cents in value does not matter. Scope insensitivity will ensure that regardless of the actual monetary value of the tips given, people who were tipped would feel obligated to contribute back to the community, including being an evangelical themselves.

- “Once upon a time, three groups of subjects were asked how much they would pay to save 2000 / 20000 / 200000 migrating birds from drowning in uncovered oil ponds. The groups respectively answered $80, $78, and $88 [1]. This is scope insensitivity or scope neglect: the number of birds saved – the scope of the altruistic action – had little effect on willingness to pay.”

Finally, this tendency for widespread tipping contributes to the familiarity principle, also known as the mere exposure effect. This is a complicated way of saying that because it is tipped so widely amongst non-shibes, it will be familiar to other non-shibes. Ceteris Paribus, the more often something is seen, the more pleasant and likeable it is. This will create pressure for other non-shibes to join the dogecoin community on their own volition, out of free will. This will ensure that dogecoin spreads really quickly.

The Twin Memes

However, widespread tipping is not the only reason why dogecoin has such a ridiculously high basic reproduction number. Let’s now analyze dogecoin in the context of an internet-meme, not merely the Richard Dawkins definition.

Critics argue that dogecoin will never succeed because it is a meme. They are badly mistaken. Dogecoin will succeed precisely because it is a meme – and a very powerful one at that!

Yes, dogecoin is ridiculous. It is a joke. The Shibe Inu meme, whilst a fascinating phenomenon, is silly. But who’s to say that silly memes can’t be worth ridiculous sums of money?

For example, the “I can Haz Cheezburger” site, based on user-uploaded pictures of cats with funny captions, has been valued at a minimum of $30 million dollars. Their book, “How to Take Over Teh Wurld”, has entered the number one spot of the New York times bestseller list. Humor is a fundamental part of the human experience, and it’s a contributing factor to memetic appeal, not a handicap. There is no reason why dogecoin is somehow an exception.

At great risk of jinxing cryptocurrencies to the same fate, I will also note that at their peak, soft stuffed toys called Beanie Babies were also worth ridiculous sums of money — hundreds of millions of dollars. Much like doge, something that was initially cute and funny became very valuable. Is it stupid? Yes. But is there profit to be made? Yes.

Like it or not, the dogecoin community is cute and funny in a way that no other cryptocurrency has managed to be. Look up the /r/dogecoin subreddit, and you’ll find that a great number of popular posts are jokes and pictures of cute dogs, rather than talking about the evils of Ben Bernanke or the fractional banking reserve system seen in /r/bitcoin.

doge ruins guy’s life. wow.

Even if you might find it uncute and unfunny, it’s difficult to deny that the Shibe Inu meme appeals to many others. Good investors don’t buy or sell instruments based on what they personally enjoy. That is irrelevant. It is more important to predict what others are likely to enjoy. The same concept applies here. The Shibe Inu meme appeals to people, so even if I don’t personally like it, I buy based on the expectation that others will.

The Red and Blue Oceans

This brings me to my next point, which is that dogecoin has successfully managed to tap into a demographic that no other cryptocurrency has. Bitcoin appeals to libertarians and anarcho-capitalists. /r/bitcoin even lists /r/anarcho_capitalism on its sidebar! While this ideological association was beneficial in attracting fanatics during the early days of bitcoin, as we move towards mainstream adoption, the same advantage can become a disadvantage — subsequently driving away many others who aren’t radically right wing. Eventually, as the pool of radical right wingers get exhausted, bitcoin will find itself with insufficient room to grow.

Dogecoin does not suffer from this flaw. It is non-political and funny – appealing to people from all sides of the political spectrum; as well as the apolitical. The technical term for this tactic is the Blue Ocean strategy. It is not necessary to offer a superior product than your competitors to gain a profit — you can also find a way to create demand in an untapped market space. This is exactly what dogecoin attempts to do.

If you fit the target audience of this document, you will not believe that there are actually those who are scared off by your politics. But such people are commonplace — for instance, this guy. People want to run away when you try to convince them of the evils of the Federal Reserve. Your assumption that everyone is as political as you are is a case of the typical mind fallacy. After all, if it were complete consensus that it was an awful thing, it would long have been voted away already.

But I digress. Does dogecoin appeals to a mass market in a way that no other cryptocurrency can? Yes it does.

This is a very good thing. It means that dogecoin has a lot of room to grow. It can hit mainstream status with greater ease than any other coin.

The Madness of Crowds

The other thing that struck me about dogecoin is that it has fanatics in the way that bitcoin had during its early days. The fundamental reason bitcoin succeeded was not because of its superior protocol. It was because bitcoin had fanatics. People who would proselyte bitcoin as though it were the second coming of Jesus – that it was the solution to all the evils of banking and government, that it would fully anonymize currency and wrest control out of the hands of our evil Federal Reserve overlords.

If Bitcoin didn’t have fanatics, then it would have been like any other speculative bubble — over at the first crash. Why would anyone choose to be the first few people to put money into such a risky asset? Without the promise of greater profits to come, only a belief that investing in bitcoin was actually an ethical duty could convince super-early adopters. This happened to be the case.

Of course, with the benefit of hindsight, we now know that the promises of bitcoin was an exaggeration. Don’t get me wrong, bitcoin certainly improved things – I myself was a bitcoin fanatic. But we can see now that the status-quo was still maintained – that Governments still exert control over cryptocurrencies, and that it’s still the case that a very small number of bitcoin owners hold a disproportionate number of bitcoins.

But that’s not my point. My point is that fanatics are powerful because they will obtain converts at any cost, regardless of profit margins. They will announce their causes from the tops of mountains and will never give up, regardless of how awful the situation looks. They refuse to change; so the world changes along with them.

The only cryptocurrency I have ever observed to have a similar fanatical community is dogecoin. Don’t get me wrong, there are certainly a number of fanatics in ripple, litecoin, and peercoin as well. I’ve talked to them. But what impresses me is the number and quantity of fanatics in dogecoin. People who will donate massive amounts of their own money in order to promote dogecoin. People who generously tip when they should have defected and let other shibes tip for them. People who refuse to sell out their dogecoin in the face of a crash, only buying more.

In the end, I suspect that it is this attribute that will ensure Dogecoin’s long term success.

Developers, Developers, Developers!

Many other cryptocurrencies — Litecoin particularly, argue that strong developer support is evidence of the superiority of their coin. The more active the developers, the more likely that cryptocurrency is to succeed. I agree with this. Developers are important because they are key to providing the infrastructure around a coin, allowing greater levels of adoption and ease of use. They also allow greater incentive to adopt the coin through the provision of important goods and services.

If this is the case, then Dogecoin’s ability to succeed depends on its developing community.

There is strong evidence that Dogecoin has one of the fastest growing and most active developer communities of any other altcoin. The two founders of Dogecoin, Jackson Palmer, and Billy Marcus, are very active. They openly discuss any issues that Dogecoin might face in the future, as well as work with the community to find the best way to resolve them. They reply quickly and concisely to proposed changes to dogecoin’s protocol. This immediately gives Dogecoin an advantage that many other cryptocurrencies do not have — Bitcoin being a major example. Satoshi Nakamoto, the main person responsible for bitcoin, disappeared in 2010, never to be seen again.

On the other hand, it can be argued that the protocol’s developers not as important as the developer community surrounding a cryptocurrency. This is because whilst the founders of the coin are necessary on rare occasions where forks are necessary, the developer community surrounding the coin are what’s really necessary necessary to allow the coin to propagate. In this area, we have a clear leg up above all altcoin-competition. The following is a list of what I believe is the most critical infrastructure necessary to the propagation and usage of a coin. (*2) It is immediately obvious that Dogecoin clearly wins against all the other major altcoins.

| Infrastructure | Dogecoin | Bitcoin | Litecoin | Peercoin | Namecoin |

| Dedicated Reddit Tip bot | Yes | Yes | Yes | No | No |

| Lite Wallet | Yes | Yes | No | No | No |

| Email/Text/Twitter Tip bot | Yes | No | No | No | No |

| ATM | Yes | Yes | No | No | No |

| In-store currency sales support | Yes | Yes | Yes | No | No |

| Dedicated Gambling Services | Yes | Yes | Yes | No | No |

| Dedicated Fiat Exchange | No | Yes | No | No | No |

| Dedicated Black Market | Yes | Yes | No | No | No |

| Total: | 7 | 7 | 4 | 0 | 0 |

And yes, I admit that although Dogecoin’s development team is impressive, the ultimate victor is Bitcoin. However, it is important to remember that we have come this far despite dogecoin being a cryptocurrency less than two months old — whilst all the other coins have had years to develop services. The fact that we have managed to compete at all is a testimony to dogecoin’s development community. It’s reasonable to extrapolate that in time, Dogecoin will have the same top-tier infrastructure that Bitcoin has.

_______

*2: This list is based on research to the best of my googling abilities. If it is inaccurate in any way, please drop me a message, and I will correct it.

By “dedicated”, I mean a site that is solely dedicated to that particular type of cryptocurrency, and not used for any other. As a result, Vault of Satoshi for dogecoin does not count.

_______

The 4chan Effect.

Although it is impossible to talk about 4chan as one coherent, organized entity, it is still fair to say that dogecoin is very popular at 4chan. Popular 4chan boards like /g/ or /biz/ usually have up to three or four dogecoin related threads at any one time. This is significant for 4chan because it threads are pruned very frequently on a regular basis — the average thread lasts for only an hour or two before being deleted due to lack of activity.

Furthermore, 4chan is known to have great ability to spread memes, ideas, and coordinate projects if the proper motivation exists. Some rumors state that every single meme every created begins at 4chan.

The good news is that this motivation exists. We have seen constantly high levels of interest at 4chan. This discounts the financial incentive they have for making Dogecoin popular. So it will.

It is difficult to explain how significant this power is for those who are not familiar with 4chan, so I ‘ll leave it at that. You yourself can choose to decide how important this factor is.

The Evidence

Every good rationalist and epistemologist will propound the importance of testing your predictions against the real world observations that should arise if they are true. I have made these predictions in late 2013. It is currently the 5th of February.

So far, I’ve had about a month of time to observe whether my theories are correct. I believe these observations is good evidence for my observations. Consider the following:

- The dogecoin subreddit has grown at a completely astounding pace with remarkable consistency.

- In the last two weeks, it has hit the fastest-growing non-default subreddit five times. It is the second fastest growing subreddit this year. As of right now, it has 55k subscribers. Litecoin only has 18k. If trends continue, it is set to overtake /r/bitcoin in number of subscribers within two months.

- Dogecoin has a higher number of unique transactions per day than both bitcoin and litecoin combined. (Unique means that you can’t send transactions back and forth between addresses you own and have that count. So this cannot be faked). It has managed to maintain this feat for over a month. This statistic excludes tipping and trades on exchanges, which is all internally calculated.

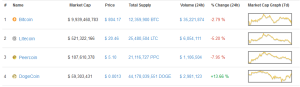

- Even in terms of sheer volume (volume exchanged in USD), Dogecoin has overtaken Litecoin, and is already more than half as popular as Bitcoin. Now remember that dogecoin has merely a market capitalization 1/12th that of litecoin, and two hundred times less than bitcoin.

- Dogecoin has more active addresses than all other cryptocurrencies combined. This means that whilst other coins may be hoarded, dogecoin users are actually actively sending transactions back and forth to each other.

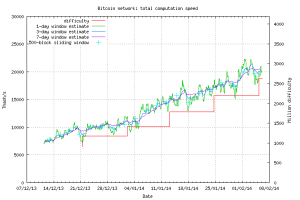

- As of the 22nd of January, dogecoin has overtaken litecoin in Hashrate. There are now more miners mining dogecoin than litecoin.

- As of February, Dogecoin is more widely searched in Google than litecoin.

- Dogecoin has a staggering 9,731 nodes, more than any other cryptocurrency, including bitcoin.

- Dogecoin now has four times as many news articles as litecoin, according to Google News.

- Dogecoin’s market cap has increased from the 14th position from the time this prediction was made to the 4th position.

Not bad for a cryptocurrency only two months old. No other coin has ever experienced this level of growth in such a short amount of time. This is a huge testimony to dogecoin’s effectiveness.

Who has the superior protocol? Really.

Despite all this evidence of dogecoin’s incredible growth rate and memetic appeal, there are skeptics everywhere. The most frequent criticism is that Dogecoin’s code is simply a copy of Litecoin’s. As a result, dogecoin is doomed to fail because it offers nothing special over currently existing cryptocurrencies. Therefore even if in the short term dogecoin is beating litecoin, it’s probably a fad. Dogecoin is overvalued, and in the long run everyone in dogecoin will soon join litecoin.

This is an awful argument.

Firstly, the argument that software is the only factor contributing to the success of a coin is incredibly short-sighted and narrow. There have been plenty of examples of coins that had really neat or good protocol, but failed due to lack of community support. Blakecoin (really fast algorithmic hashrate) is a low hanging fruit examples.

Haven’t heard of it before? Exactly.

Software is not the only factor that distinguishes coins from each other. It is not even the most important, especially for low levels of novelty. Instead, it is really the culture of dogecoin that separates it from any other coin, and that is something much more difficult to imitate, unlike code where copy and paste would suffice.

The failure to take into consideration sociological and psychological factors that drive the success of an innovation is a temptation. After all, it is far more difficult to quantify and objectively access. However, it is no less important, because it is a far better predictor of adoption than any slightly superior hashing function. Nobody is going to join a cryptocurrency if nobody spreads it in the first place.

Secondly, this argument is wrong because dogecoin’s protocol does offer something that no other major cryptocurrency has.

The power of Large Numbers

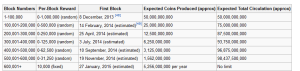

Dogecoin will have 45 billion coins by the time this document is written. By the end of this year, it will have 100 billion. Bitcoin, in comparison, only has 21 million. This matters more than you think.

Humans run on corrupted hardware. Due to the anchoring effect, people enjoy owning larger numbers of things than small numbers. It is more pleasant and desirable to own 100 Blerghcoins than 0.001 Urdcoins, even if they are worth the same monetary value.

The mainstream public is discouraged from buying bitcoin if they realize it has a price tag of a thousand USD per coin. Even if it is possible to own fractions of that coin. Even if it’s possible to own a cent worth of bitcoin.

In theory, it should not matter. Perfectly rational beings would perform a utilitarian cost-benefit analysis and simply do whatever maximizes utility. However, homo economicus do not exist. People do care about irrelevant numbers, and this is called Psychological pricing.

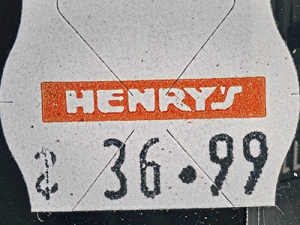

Ever noticed that stores tend to end their prices in denominations of 9?  This is because people buy more of the good when they do. Stores than try to get rid of such pricing often find their sales dropping by up to 80%. The solution is not to criticize such people as ‘irrational’ but to plan your product around them to maximize appeal. Dogecoin does that.

This is because people buy more of the good when they do. Stores than try to get rid of such pricing often find their sales dropping by up to 80%. The solution is not to criticize such people as ‘irrational’ but to plan your product around them to maximize appeal. Dogecoin does that.

For the same reasons, people find it more pleasant to own exact integers of an item. People will be less reluctant to pick up a currency where each coin is worth cents, rather than hundreds of dollars, since they have already been anchored by regular denominations of money.

Furthermore it’s difficult to calculate transactions in very small orders of magnitude. The majority of everyday transactions are around a few dollars. This translates to something like 0.00237 bitcoin. Such fractions are annoying and difficult to calculate – even more so to mathematically illiterate people. And although litecoin suffers from this problem less, this is because it has a lower market cap divided by only 25 million coins, rather than because it is a permanent solution.

Only Dogecoin solves this problem by anticipating this and significantly increasing the number of coins in supply.

Some people say that all these problems can be solved by forking bitcoin and multiplying the number of coins by a thousand.

This won’t happen. This is a solution that requires massive coordination from a huge majority of its participants to safely be done. For the last 3 months, many have repeatedly requested to switch to the mBTC system instead, with multiple threads on /r/bitcoin pleading for admins and higher-ups to support this effort. Including me.

This has been for naught. Once again, this is because what works in theory often does not work in practice. This is the same reason why bitcoin has not switched to a superior scrypt protocol, or faster difficult adjustments, or confirmation times, and is unlikely to do so in the future.

Big organizations are highly bureaucratic and inflexible. What were you expecting?

The Fastest Hare

Bitcoin requires ten minutes, on average, for each confirmation. This means that each transaction takes twenty minutes to safely validate. Even Litecoin takes 2 minutes.

Dogecoin takes only one.

For obvious reasons, quick transaction times are very useful. Buying and selling things became easier. You can actually use doges in brick and mortar stores now, rather than waiting an impractical 20 minutes. This makes point-of-sale transactions possible.

Yes, there are third parties that help to expedite this, such as coinbase. But wasn’t one of the purposes of cryptocurrency to leave as little power as possible to big organizations, and instead put that power into the hands of the people? If we were going to entrust all our currencies with third party organizations to do transactions for us, then why not use ActualMoney ™ and banks in the first place?

Furthermore, there are major security advantages to faster block discovery, since more confirmations are now possible in the same amount of time, greatly increasing the hash power necessary to perform a gambler’s ruin double-spending attack.

Bitcoin and Litecoin will never fork for faster transaction times. If they could, they would have done it ages ago, as with the mBTC fiasco. Only a new, competing coin can offer a solution. Dogecoin does that.

Survival of the most Adaptable

Bitcoin has a difficulty retargeting time of 2 weeks. Litecoin? 3.5 days. Dogecoin – every 4 hours.

This not only gives greater security from mining-attacks, but also reduces the volatility of monetary supply. For those of you who mine bitcoin, you’ll understand exactly why this is so important. The ASIC arms race causes spikes in bitcoin’s supply at the start of every two weeks, only to dwindle down to nearly none. This is horrible for currency stability. Not to mention the sudden reduction in supply after crashes — when miners drop out.

Once again, Dogecoin solves this problem where bitcoin does not.

Inflation – The Austrian’s nightmare?

Dogecoin’s inflation rate and block reward schedule is superior to all other major cryptocurrencies. That’s right. You heard it here first.

For the sake of reference, here’s dogecoin’s expected money supply.

Here is bitcoin’s .

There’s been a lot of misunderstanding and confusion going around dogecoin’s inflation rate recently. For some reason, people don’t understand it very well. Some people will notice that dogecoin increases by 5 billion coins every year after 2014. Forever. That is when they start to freak out. Then they panic and declare dogecoin a sinking ship and cash out all their doges. They are idiots, and here’s why:

Firstly, Monetary inflation does not mean price inflation. It is possible for a currency to increase in supply and value at the same time. For instance, bitcoin grew 10000% in price the same year when its monetary base also increased by 13%.

Secondly, consider that in the second year of dogecoin’s existence, we will have a 5% increase in total money supply. Do you know what bitcoin and litecoin had? Here’s a convenient table for you.

| Year | Dogecoin Inflation | Litecoin Inflation | Bitcoin Inflation |

| 1 | 100% | 100% | 100% |

| 2 | 5.26% | 50% | 50% |

| 3 | 5% | 33% | 33% |

| 4 | 4.76% | 12.5% | 12.5% |

| 5 | 4.54% | 11.1% | 11.11% |

| 6 | 4.35% | 10% | 10% |

| 7 | 4.2% | 9.09% | 9.09% |

Of course, the difference is that dogecoin continues adding to its supply by 5 Billion coins each year, whilst bitcoin and litecoin will continue to halve to zero.

Do you want to take a guess at which year dogecoin will catch up to bitcoin in total monetary supply added?

The year 2174.

You won’t even live that long. *1

This is the misleading part about Dogecoin’s monetary supply. People see the scary “5 billion coins added each year!!!” statement and they start pissing their pants at vivid imagery of Weimar’s hyperinflation. They forget that Dogecoin is way ahead of the curve, because instead of halving every 4 years as bitcoin or litecoin does, it halves every 1.5 months. This gives it a lot of room to catch up, even if the total monetary supply increases by 5 Billion coins indefinitely.

Here’s the thing. Imagine you wanted to create the best, most profit-maximizing coin possible. What specifications would you want? Obviously, you’d want a coin that halves in rewards as quickly as possible. The faster it halves, the more coins you get (because you mined it since the beginning), and the less coins others get. This also makes the coin rarer, so as supply drops, demand goes up.

But on the other hand, you can’t have the coin halve too quickly. If you did that, there would be accusations of the coin being an instamine scamcoin. One halving every 2~ months sounds about right.

What happens when it stops halving? After that, you want a static, minimal, eternal block reward to support and encourage miners. Miners not only secure the network, but it makes up for lost, destroyed, or stolen coins, which leads to lower levels of volatility and a more secure infrastructure. They also help generate interest in the coin. This is paradoxically good for the value of the coin in the long run. This is where you get the profits.

Dogecoin has all of these traits. Dogecoin’s block rewards are perfectly optimized to be worth as much as possible. Not even bitcoin or litecoin accomplishes that. Why halve in four years, when you can do it in two months?

This should be obvious. And yet people on all sides of the inflation argument appear confused and needlessly agitated. It’s not just the anti-inflation sides of dogecoin that are angry and tout falsehoods. Even the dogeflation proponents on my side argue completely awfully.

For instance, there’s a popular rhetoric about “dogecoin having inflation is good because it incentivizes people to spend money, thus promoting dogecoin”.

This is wrong on so many levels.

That logic will only apply if you are only allowed to use one currency. In the case of Government mandated fiat currency, this applies, because you only have one currency to choose from. Therefore you want to spend your dollars as soon as possible. In cryptocurrency, where there are over nine thousand possible competing alternatives, if dogecoin loses value in the long run, everyone would go buy a non-dogecoin cryptocurrency instead.

This is the kind of pseudo-Keynesianism that gives Keynes a bad name. But I digress. This argument is further invalid because Dogecoin will not have inflation. Dogecoin is going to increase in value. Massively. This entire essay is dedicated to arguing that.

Dogecoin is a deflationary currency. It is NOT inflationary.

If you catch anyone who says that kind of thing, please slap them. Hard. And then refer them to this document. Thanks.

_____

[1]* Those who know me well will know that I am a Transhumanist. This statement is intended to get my point across, not an assertion of fact.

_____

Throughout the document, I hope to have demonstrated very good reasons why dogecoin will succeed. I think after all this, it’s safe to say that dogecoin is at least a superior product to litecoin, due to the significant advantages it holds.

Litecoiners are probably going to protest: “But Dogecoin is still just a litecoin clone! Why should anyone actually invest in dogecoin rather than litecoin? We should be the default option because of network effects!”

Silly litecoiners. Network effects no longer apply when there is hard evidence that huge masses of people are switching to an alternative despite an already existing competitor. Network effects are invalid when we have evidence that dogecoin is used more frequently than Litecoin using every metric conceivable. Furthermore, network effects are not an all-encompassing property that forever prevents the rise of new competition. Litecoin may pretend to be the Silver to Bitcoin’s gold, but we all really know that Dogecoin is the Facebook to Litecoin’s myspace. In the long run, it is inevitable that dogecoin will win.

Thanks a Lot !! Really helpful blog ;)

[…] (See also Tuxedage’s post – A serious Analysis of Dogecoin — Or: Why I am all-in on dogecoin) […]

It seems that my criticisms were correct.

things might be extremely trending up in the coming lifetimes. Portugal seems to be the next state for primechain to become used for payment

I think it boils down to transactions sizes… If you shift say $ 1 000 000 …. it would be better to wait for at least 6 to 7 confirmations as a merchant. The risk

is just that much lower, if you wait it out. It would be ridiculous to wait 6 to 7 confirmations for say $1 purchase. If you compare this with other payment

methods out there, 10 minutes will not be an issue for bigger amounts. If you want zero confirmations, use off-chain payment services.

It has the which signifies that we assign to it and that we discover for it, not that someone else like a spiritual leader assigns for us. Most of us uncover that not debilitating nonetheless empowering. It wasn’t merely the fawning Democrats who were enabling this circus, however there have been many, sadly, many sycophantic Republicans who helped as properly,” Malkin stated. First, I’m ready to admit that I’m a phoney, sycophantic arse-kisser and that I am additional of one than Mr Johnson (or my husband).

Just stumbled on this article, very glad I read this after doge took a dive. Has anyone heard from the author lately? He hasn’t posted anything in months, the last post being his “My ten rules of trading”.

His timing was terrible, 6 days after he posted this doge popped to an all time high then almost hit an all time low in August. Its been mostly in 5th place on coinmarketcap.com but has dropped as low as 8th the past 2 months.

I hope Tuxedage is doing ok and not sleeping on a park bench somehwere. He went all in and lost big time. Ironically, maybe someone could start a bitcoin donation fund for this guy? I don’t think he’d even mind litecoin donations.